If you’re interested in life insurance, one major decision is figuring out which type makes the most sense for you. The kind you choose can make a significant difference in cost, benefits, and the duration of coverage.

Term and whole life are two of the most popular policies. Here’s how term vs. whole life insurance compares so you can make a more informed decision and find the right fit.

What Is Term Life Insurance?

Term life insurance is temporary life insurance. It covers you only for a set number of years. If you pass away during the term, your heirs receive a death benefit from your policy. If you outlive the term, your coverage ends. That design helps make term life insurance generally more affordable compared to other options.

How Term Life Insurance Works

When you sign up for term life insurance, you pick how long you want the coverage to last. A policy could last from only one year to 30 years or longer, depending on the insurer.

After you sign up, your premium stays the same during the entire term. Longer terms cost more because insurers cover you until an older age, when the risk of passing away increases.

If you outlive the term, you’ll need to buy another life insurance policy to continue protecting yourself and your family, which means passing health underwriting again.

However, some term policies offer the option to renew and extend coverage without requiring another medical exam. The premium will become more expensive, though, to account for the fact that you’re renewing at an older age.

Guaranteed Acceptance Life Insurance

Coverage options starting at $9.95 a month!

Guaranteed acceptance life insurance without medical exams, health questions, or rate increases.

Benefits of Term Life Insurance

- More affordable. Term life insurance tends to be the least expensive type of life insurance. It’s possible to buy a six-figure death benefit at a relatively affordable cost.

- Simple to understand. Term life insurance tends to be a straightforward product. You choose the amount of coverage you want and how long it lasts. That’s it. With fewer features, term life is easier to understand.

- Extensions on some policies. Depending on your contract terms, your term policy may be renewable past the original expiration date, even if you have health issues. Term policies could also be convertible. This gives you the option to switch part or all of the coverage to permanent coverage, like whole life, without a medical exam.

What Is Whole Life Insurance?

Whole life insurance is a type of permanent coverage that does not have an expiration date. As long as you continue to pay the premiums, the coverage is guaranteed to last for your entire life. Whole life insurance gives you a way to buy coverage that will definitely pay a death benefit, no matter how long you live.

How Whole Life Insurance Works

When you sign up for whole life insurance, you pick how much coverage you want, and the insurer will tell you the premium. Premiums tend to start higher than term life, but they are guaranteed not to increase after that.

In addition to the death benefit, some whole life insurance policies offer cash value. This is a reserve of money you can tap into while you are alive. As you pay premiums, your cash value balance grows over time. The insurer also pays a return on your cash value, which is guaranteed.

If you need the money, you can withdraw or borrow from your cash value balance. Taking out cash value does reduce the amount left for the future death benefit, though.

Benefits of Whole Life Insurance

- Can guarantee lifelong coverage. By design, whole life insurance is meant to last your entire life. If you commit to always paying the premiums, you can ensure your heirs receive a death benefit payout. You don’t have to worry about paying for years of insurance premiums for a policy that never pays anything back.

- No risk of future cost increases. Since whole life insurance locks in the premium, your costs will not go up as you get older. That can help make long-term budgeting more predictable.

- Builds savings along with insurance protection. If your whole life insurance policy includes cash value, you gradually build savings as well as protect your loved ones. That’s a reserve of money you can tap into as time goes by, whether for emergencies, retirement, a family member’s college expenses, or other financial goals.

Key Differences Between Term and Whole Life Insurance

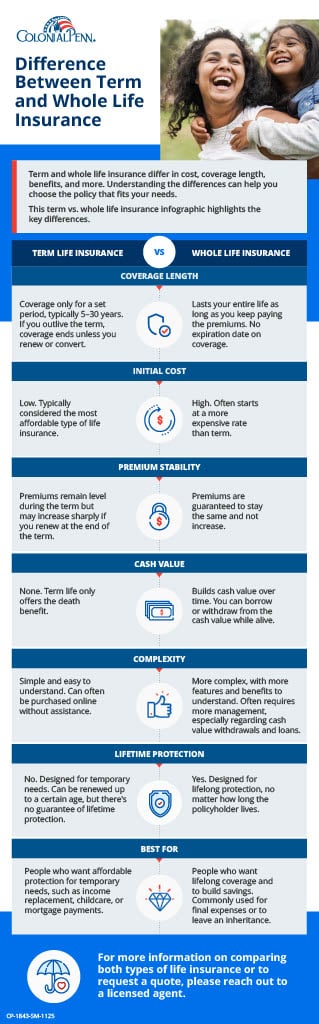

Now that you understand how both types of life insurance work, how do they compare? This term vs. whole life insurance infographic highlights the key differences.

Choosing Between the Two

Neither term life nor whole life is better than the other. But they are very different products that serve two distinct needs. Here’s how to determine which is right for you.

Who Is a Term Policy Best Fit for?

A term policy is best fit for temporary needs that will eventually go away as you get older. For example, you might buy term life insurance to protect your family until your kids grow up, to replace your income for others until you retire, or to cover the mortgage on your home until it’s paid off. You can pick a term that lasts until you reach these milestones and no longer need coverage.

Since term life insurance tends to be much less expensive, it can allow you to buy a much larger death benefit. It might be prohibitively expensive to buy enough coverage to replace an entire career’s income or a whole mortgage with permanent insurance, but it’s usually possible with term insurance.

Who Is a Whole Life Policy Best Fit for?

A whole life policy is best fit for lifelong needs that never go away. Paying for final expenses and leaving an inheritance are common goals. With whole life insurance, you can ensure that your loved ones will get the death benefit payout, no matter how long you live, as long as you pay the premiums.

Whole life may suit people with larger budgets who want to build wealth alongside insurance protection. Think of whole life like buying a home and term as renting one. But don’t sacrifice coverage. It’s usually better to have enough protection with term insurance than too little with whole life insurance.

Keep in mind that choosing between term vs. whole life Insurance is not an either/or decision. Someone could use a mix of both types. For instance, someone could buy a term policy with a large death benefit to replace their income and a smaller whole life policy for future final expenses. Or, someone could use term while they’re working and then buy whole life after they retire.

An insurance professional can help you determine which type makes sense and guide you through the application process.

FAQs

Can I Switch Between Term and Whole Life Insurance?

Yes. Some term policies are convertible, allowing you to swap the coverage for whole life insurance without a medical exam. If you have a whole life policy with cash value and no longer need the permanent coverage, your insurer may allow you to substitute the cash value for a paid-off term policy that doesn’t charge premiums.

How Long Can Term Life Insurance Be Renewed?

Term life insurance renewals typically have a maximum age limit. For example, they may not allow for renewals past age 70. If you live past that, then you no longer have the option to extend. For this reason, term insurance does not guarantee lifelong coverage in the same way whole life and other permanent policies do.

Is It Harder to Qualify for Term or Whole Life Insurance?

Qualifying for term and whole life insurance is generally the same. Health requirements depend more on the amount of coverage than the policy type. That said, some whole life policies are guaranteed issue, meaning they require no medical exam to join. While no-exam term policies exist, they’re less common.

Colonial Penn is here for you!

Colonial Penn has specialized in making life insurance simple and accessible by offering it directly to consumers since 1957. Click here to learn more.

Insurers and their representatives are not permitted by law to offer tax or legal advice. The general and educational information here supports the sales, marketing or service of insurance policies. Based upon individuals’ particular circumstances and objectives, they should seek specific advice from their own qualified and duly-licensed independent tax or legal advisors.