Before you purchase any financial product, you need to know how it works. That includes understanding the terms in your contract.

If you’re shopping around for life insurance policies, one of the terms you may come across is “unit of coverage.” Here’s a look at what that means and how it applies to your situation.

What Is a Unit of Life Insurance Coverage?

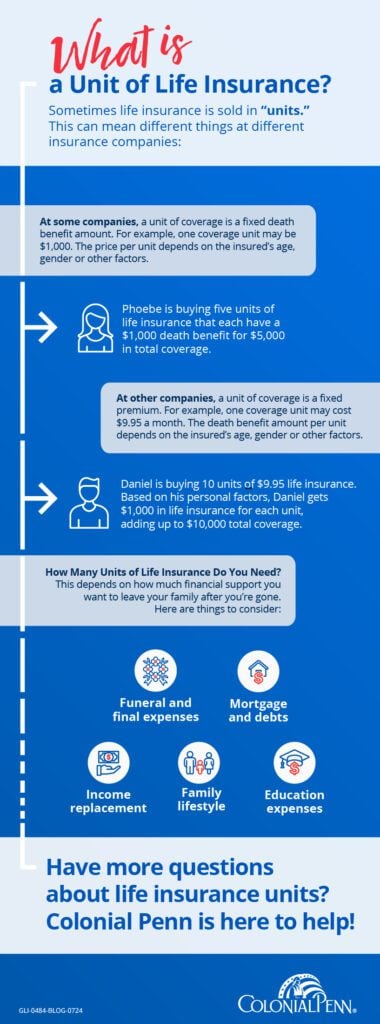

A unit of coverage refers to a life insurance policy’s base death benefit amount. For example, if one coverage unit is $1,000 and you buy a policy for one unit, your death benefit is $1,000. Buying additional units increases the total death benefit. To continue this example, five units would provide $5,000 of coverage. The death benefit for one unit may vary based on your age, gender or other factors.

How Do Insurance Companies Use Units of Coverage?

Insurance companies may use units of coverage to determine your death benefit amount or premium. With many life insurance companies, the unit of coverage is set at a fixed death benefit amount. A common amount is $1,000, but it can vary. Check with each prospective insurer to know how it values one unit.

When the insurance company quotes your policy, it determines the cost of giving you $1,000 of coverage and sets your premium per unit of coverage accordingly. The greater the risk you pose to the insurance company, the higher your premium may be. Smoking, poor health, or other risk factors typically increase your premium.

Other times, the premium per unit is a fixed amount, and the death benefit per unit of coverage changes. So, the greater the risk you are to insure, the lower your death benefit may be.

With a guaranteed acceptance insurance policy, you’re guaranteed acceptance regardless of typical risk factors like your health and age. Plus, your premium and death benefit stay the same as long as you have the policy.

Guaranteed Acceptance Life Insurance

Coverage options starting at $9.95 a month!

Guaranteed acceptance life insurance without medical exams, health questions, or rate increases.

How Many Units of Coverage Do You Need?

One common reason to buy life insurance is to provide financial protection for your loved ones when you die. By ensuring your beneficiaries receive the death benefit from your life insurance policy, you could help shield them from financial difficulties.

The units of coverage you need depend on the amount of financial support you want to leave your family. Here are a few factors to consider when weighing how many units of coverage are right for your situation:

- Your funeral and burial arrangements will likely have associated expenses.

- You may bring in income your family or spouse relies on, such as wages and earnings from a job or self-employment or income from a pension, annuity, or Social Security benefits if you’re retired. If that income stops or reduces when you pass away, a life insurance payout could help support your loved ones.

- Your beneficiaries may need to take time off from their jobs to grieve, or they may be unable to focus for a while. These situations can reduce their income. Again, a payout from your life insurance policy can help ease that strain.

If you want to pay off significant debts like mortgages or leave your spouse with a large enough payout to quit work, you may need a sizable policy. If you only need to cover smaller amounts like burial expenses or property taxes on a home you own, a lower level of coverage may be sufficient.

Once you understand how much financial support you want to provide, read your life insurance contract to ensure you’re buying the right amount of coverage.

Securing Your Loved One’s Financial Future

If you have additional questions about life insurance and how many units of coverage you need, speak to a licensed insurance agent. The professionals at Colonial Penn can explain how policies work and give you a free quote.

Insurers and their representatives are not permitted by law to offer tax or legal advice. The general and educational information here supports the sales, marketing or service of insurance policies. Based upon individuals’ particular circumstances and objectives, they should seek specific advice from their own qualified and duly-licensed independent tax or legal advisors.

Colonial Penn is here for you!

Colonial Penn has specialized in making life insurance simple and accessible by offering it directly to consumers since 1957. Click here to learn more.