Workers are facing rising costs and many are eager to increase their wages or advance their careers to help offset the expenses but the downside is that this can possibly lead to a loss of assistance or income known as a benefits cliff.

On this page

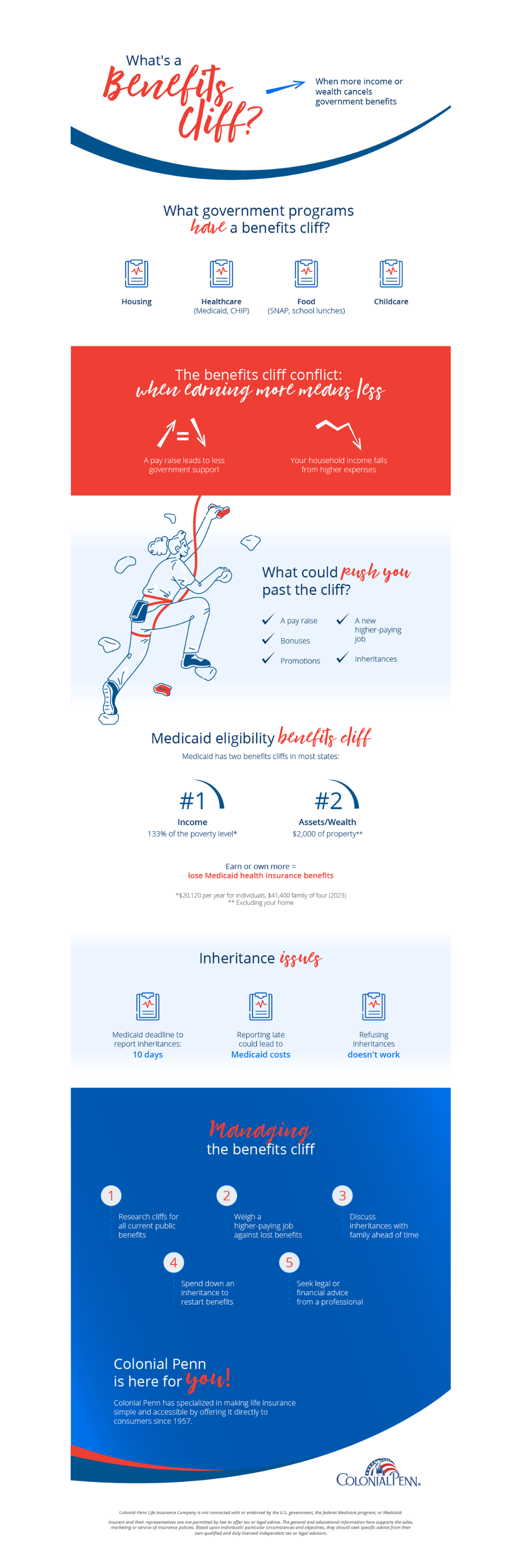

What is a Benefits Cliff?

A benefits cliff occurs when workers who receive public benefits for food, housing, childcare or healthcare find that receiving a pay raise prevents them for continuing to qualify for assistance. Their total income is reduced due to loss of benefit, yet they still aren’t earning enough to be able to sustain themselves and their families. The challenge is that most workers do not know where their “cliff” is, and that makes it difficult to know how many additional hours they could work, which level of pay increases will help them out and whether taking a higher paying position would be beneficial. According to Dave Altig, executive vice president and director of research at the Federal Reserve Bank of Atlanta, the benefits cliff typically affects most workers in some way who have an income up to $60,000 per year.

While there’s still a lot of data researchers need to explore about benefits cliffs, here are some important facts to consider:

- Benefit cliffs disproportionally effect racial minority groups.

- Benefits can also plateau, which means that even though a worker may make more in wages, the increase of income is basically canceled out by their loss of benefits meaning they don’t see much or an increase in their income.

- According to The Counter, an advocacy group focused on feeding families, there are two bills before federal legislators called The Hope Act, and The Asset Act, which aim to help families to be more financially secure by allowing them to apply more easily for benefits while being able to see the impact on benefits cliffs.

Medicaid Eligibility Benefit Cliff

Medicaid is a joint federal-state program that finances the delivery of primary and acute medical services, as well as long-term services and supports (LTSS), to a diverse low-income population, including children, pregnant women, adults, individuals with disabilities and people aged 65 and older.

Some applicants find they are subject to a Medicaid eligibility cliff because they earn slightly more than their state’s eligibility requirements yet they are unable to afford healthcare.

Some states have expanded coverage that allows applicants who earn less than 133% of the federal poverty level to qualify while others don’t. This helpful link from the U.S. Centers of Medicare and Medicaid Services will help you determine if you qualify. Those who do not qualify may be able to find care by accessing community healthcare.

Inheritance and Medicaid Eligibility Cliff

Medicaid is a needs-based program, which means that your earnings and assets must not exceed a pre-determined limit, or you will no longer be eligible. The thresholds vary from state to state, however, typically a person cannot hold more than $2,000 in assets and continue to receive Medicaid benefits. If a couple is married, and one of the spouses is not receiving Medicaid benefits, they may receive an inheritance without it impacting the other spouse’s eligibility. It is important to report an inheritance, within 10 days, to your state’s Medicaid office.

If the inheritance is modest, or it has been spent down within the month, Medicaid may only consider you ineligible for a certain period of time. It is important to note that depending on when you report the inheritance, you may have to pay back the cost of any Medicaid benefits you received during that time.

Refusing an Inheritance

While it may seem logical that simply refusing an inheritance could solve the benefit cliff problem, Medicaid views this as you gifting the money to someone else and it is not legal in many states. This violates Medicaid’s lookback rule and can disqualify you from receiving benefits.

Benefit cliffs can be challenging to calculate and navigate. If you feel you are subject to these cliffs, it’s best to seek legal or financial advice from a professional who can help you to maximize your income within legal limits and eligibility guidelines.

Colonial Penn is here for you!

Colonial Penn has specialized in making life insurance simple and accessible by offering it directly to consumers since 1957. Click here to learn more.

Colonial Penn Life Insurance Company is not connected with or endorsed by the U.S. government, the federal Medicare program, or Medicaid.

Insurers and their representatives are not permitted by law to offer tax or legal advice. The general and educational information here supports the sales, marketing or service of insurance policies. Based upon individuals’ particular circumstances and objectives, they should seek specific advice from their own qualified and duly-licensed independent tax or legal advisors.

Colonial Penn is a private company that is not Medicare, Medicaid or MaineCare and is not a governmental agency